- Home

- Singapore Private Property Market Trends in 2025 (Part 1 of 2)

Singapore Private Property Market Trends in 2025 (Part 1 of 2)

1. Executive Summary:

The Singapore private property market in 2025 is anticipated to exhibit a phase of sustainable growth, characterized by a moderate increase in prices, as various analyses suggest a rise between 3% and 7% . This growth is expected to be primarily driven by a confluence of factors, including a constrained supply of new properties and a resilient demand fueled by both local and, to a lesser extent, foreign interest . Notably, the projected decline in mortgage interest rates is expected to play a significant role in enhancing affordability and stimulating market activity . Concurrently, an increase in new property launches will offer a wider range of options for prospective buyers . However, the market may also face headwinds stemming from global economic uncertainties and the continued influence of government cooling measures designed to maintain market stability . The convergence of moderating price growth, more favorable financing conditions due to lower interest rates, and an increase in available properties could present a propitious environment for both buyers and investors in 2025. Nevertheless, a careful evaluation of prevailing economic conditions remains crucial for navigating the market effectively.

2. Singapore Private Property Market in 2025: An Overview:

Following a period of rapid price appreciation, the Singapore private property market has transitioned into a phase characterized by more sustainable growth . Despite some mixed signals emanating from various economic indicators , a general sense of cautious optimism prevails among property analysts regarding the market’s performance in 2025 . This positive sentiment is underpinned by Singapore’s projected gross domestic product (GDP) growth, with forecasts ranging from 1% to 3% , which serves to bolster buyer confidence. Furthermore, the consistently low unemployment rate in Singapore acts as a significant positive economic indicator, providing a stable foundation for the property market by ensuring income security for a large segment of the population. This economic backdrop suggests that despite potential global headwinds, the fundamental drivers supporting demand for private property in Singapore remain robust.

3. Anticipated Price Movements Across Property Segments:

3.1 Condominiums:

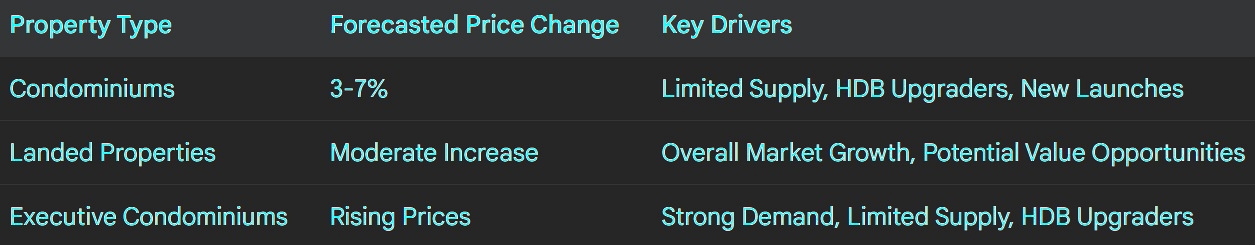

The condominium segment of the Singapore private property market is projected to experience moderate price increases in 2025, with forecasts generally ranging between 3% and 7% . Specifically, PropNex Realty anticipates a price growth of 3% to 4% and expects transaction volumes for new condominiums to reach between 8,000 and 9,000 units . A potential resurgence in market activity within the Core Central Region (CCR) is also anticipated. This could be attributed to the impact of previous cooling measures, which have reduced foreign buyer activity, and the upcoming launches of new projects such as Collective @ One Sophia and Marina View . Price benchmarks for new condominium launches are expected to vary by location, with Outside Central Region (OCR) projects ranging from $2,200 to $2,700 per square foot (PSF), Rest of Central Region (RCR) projects from $2,600 to $2,800 PSF, and CCR projects starting from $3,000 PSF . Strong demand is particularly expected for mass-market condominiums in the OCR, primarily driven by Housing and Development Board (HDB) upgraders seeking to enter the private property market . The reduced competition from foreign buyers in the CCR, coupled with attractively priced new launches, might lead to a narrowing of the price gap between CCR and RCR condominiums, presenting opportunities for local upgraders . The sustained demand for OCR condominiums reflects the significant pool of HDB owners looking to upgrade to private housing in familiar suburban locations .

3.2 Landed Properties:

While the overall private property market is expected to see price appreciation in the range of 3% to 7%, which would encompass landed properties , specific price forecasts for this segment are less prevalent in the available data. The average and median prices for landed properties in 2024, as reported in , provide a useful reference point for understanding the general price levels. It is also noted that foreign buyers face restrictions when purchasing landed properties in Singapore . One source suggests that 2025 could be an opportune time to acquire the more affordable freehold landed properties . The relative lack of specific landed property price forecasts in several reports, compared to the more detailed outlook for condominiums, could indicate an expectation of greater price stability or a less pronounced increase in this segment. The unique characteristics of landed properties, such as their limited supply and higher price quantum, likely contribute to different market dynamics compared to other types of private housing.

3.3 Executive Condominiums (ECs):

Executive Condominiums (ECs) are anticipated to experience rising prices in 2025, driven by robust demand and a limited supply of new units . Their relatively lower entry prices compared to private condominiums make them an appealing option for eligible buyers, particularly HDB upgraders . ECs also offer the potential for significant capital appreciation as they transition into fully private condominiums after a ten-year period . The strong demand from HDB upgraders ensures a healthy resale market for ECs following the expiry of their Minimum Occupation Period (MOP) . Several new EC projects are slated for launch in 2025, including Aurelle of Tampines (Q1 2025), Plantation Close (Q2 2025), and Jalan Loyang Besar (Q4 2025) . The price benchmark for new ECs is expected to be around $1,600 PSF . The continued attractiveness of ECs lies in their offering of a more accessible pathway to private housing ownership, coupled with substantial long-term growth prospects, primarily fueled by the consistent demand from the HDB upgrading segment. The upcoming EC launches are therefore likely to attract considerable interest from eligible buyers.

Table 1: Forecasted Price Movements by Property Type (2025)

4. Demand and Supply Dynamics Shaping the Market:

4.1 Key Demand Drivers:

A significant driver of demand in the Singapore private property market in 2025 is the large number of HDB flats, exceeding 100,000, reaching their Minimum Occupation Period (MOP) . This creates a substantial pool of homeowners looking to upgrade to private properties. Additionally, the formation of approximately 20,000 new households annually in Singapore ensures a consistent underlying demand for residential properties . Despite the high Additional Buyer’s Stamp Duty (ABSD) of 60% for foreign buyers, sustained interest from affluent investors in luxury properties within the Core Central Region (CCR) continues to contribute to demand . The rental market also remains resilient, supported by demand from expatriates and corporate relocations . Furthermore, there is a noted preference among some buyers for resale homes, driven by the desire for immediate occupancy and often larger living spaces compared to newer launches . The considerable number of HDB flats reaching MOP represents a reliable and significant source of demand for private housing, particularly condominiums and ECs, highlighting the importance of this demographic for market dynamics. While foreign interest persists, the substantial ABSD has likely shifted the market’s focus towards local buyers and upgraders, potentially reducing its vulnerability to fluctuations in international capital flows. Nevertheless, ultra-high-net-worth individuals may still view Singapore as a secure and stable investment destination .

4.2 Supply-Side Factors:

On the supply side, a notable trend for 2025 is the significant decrease in the projected completion of new private homes, with only 5,348 units expected, representing a sharp 41.3% decline from the 9,103 units projected for 2024 . In contrast, PropNex anticipates a higher volume of transactions for new private homes, estimating between 8,000 and 9,000 units . Approximately 16 new projects, comprising around 8,025 new units (excluding ECs), are expected to be launched in the first half of 2025 . Developers are also expected to maintain firm pricing strategies due to controlled land supply and elevated construction costs . Additionally, the supply of resale properties may remain limited due to the high costs associated with replacing existing properties and the impact of ABSD on owners of multiple properties . The considerable reduction in new home completions, despite a higher anticipated number of transactions and new launches, suggests that the market will likely experience continued pressure on prices due to limited immediate availability. This situation could particularly affect the resale market if buyers struggle to find suitable newly completed properties. The combination of restricted land supply and high construction expenses provides developers with less incentive to reduce prices, thereby contributing to the resilience of prices in the new launch market .

5. The Influence of Government Policies and Regulations:

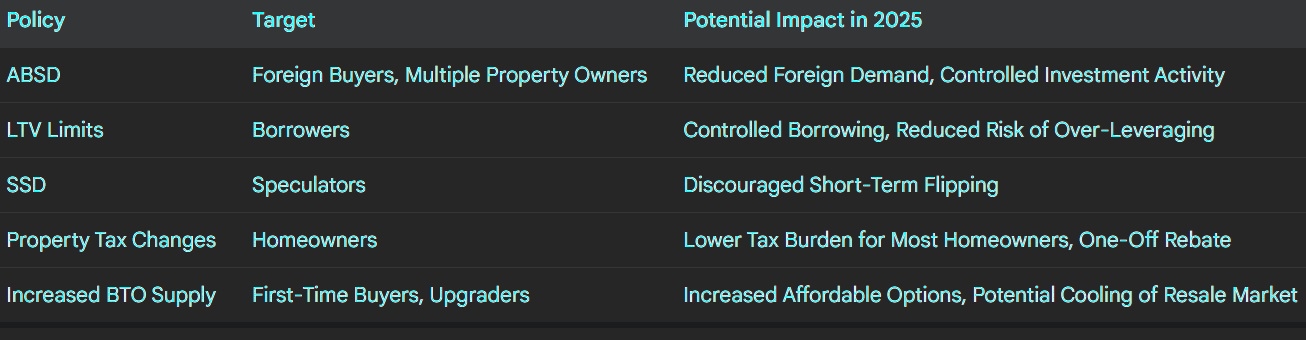

The Singapore government actively employs various policies and regulations to ensure the stability and affordability of the property market. Existing cooling measures, such as the Additional Buyer’s Stamp Duty (ABSD), Loan-to-Value (LTV) limits, and Seller’s Stamp Duty (SSD), continue to play a significant role in shaping market dynamics . There remains a potential for the introduction of new cooling measures in 2025 if property prices experience a sharp acceleration . Factors that could trigger such measures include rapidly increasing prices, a surge in foreign buying activity, a rise in short-term property flipping, and increasing levels of household debt . The upcoming release of the URA Master Plan 2025 is also keenly anticipated, as it will outline the country’s long-term land use and development strategies. Changes in property taxes have also been implemented in 2025, including a one-off property tax rebate , with the majority of homeowners expected to pay less in property taxes . Regulations for foreign buyers remain stringent, with a high ABSD rate of 60% . The government’s focus on public housing is evident in Budget 2025, which includes measures to increase the supply of Build-To-Order (BTO) flats , potentially exerting a cooling effect on resale flat prices over time. Support for schemes like the Fresh Start Housing Scheme also continues . The government’s proactive approach to managing the property market through cooling measures demonstrates its commitment to maintaining stability and ensuring affordability for its citizens. While no new measures have been officially announced for 2025, the possibility of further intervention remains if market conditions warrant it. The increased emphasis on public housing supply and affordability through BTO initiatives and support programs could have an indirect impact on the private property market by providing more affordable housing alternatives, potentially moderating demand from upgraders in the long term.

Table 2: Key Government Policies and Their Potential Impact on the Private Property Market in 2025